tax deferred exchange definition

Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today. Copyright 2007 by The McGraw-Hill Companies Inc.

1031 Exchange Explained What Is A 1031 Exchange

The company also offers strategic advisory asset management.

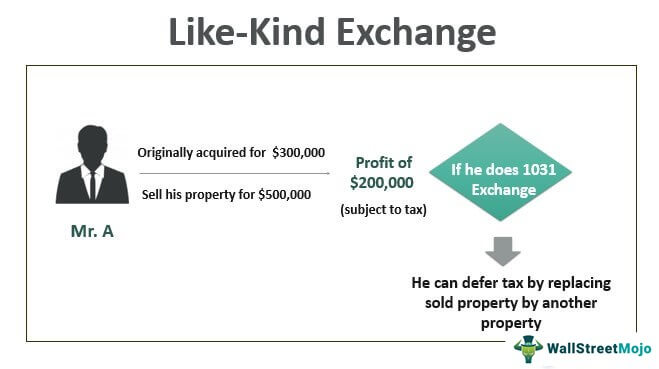

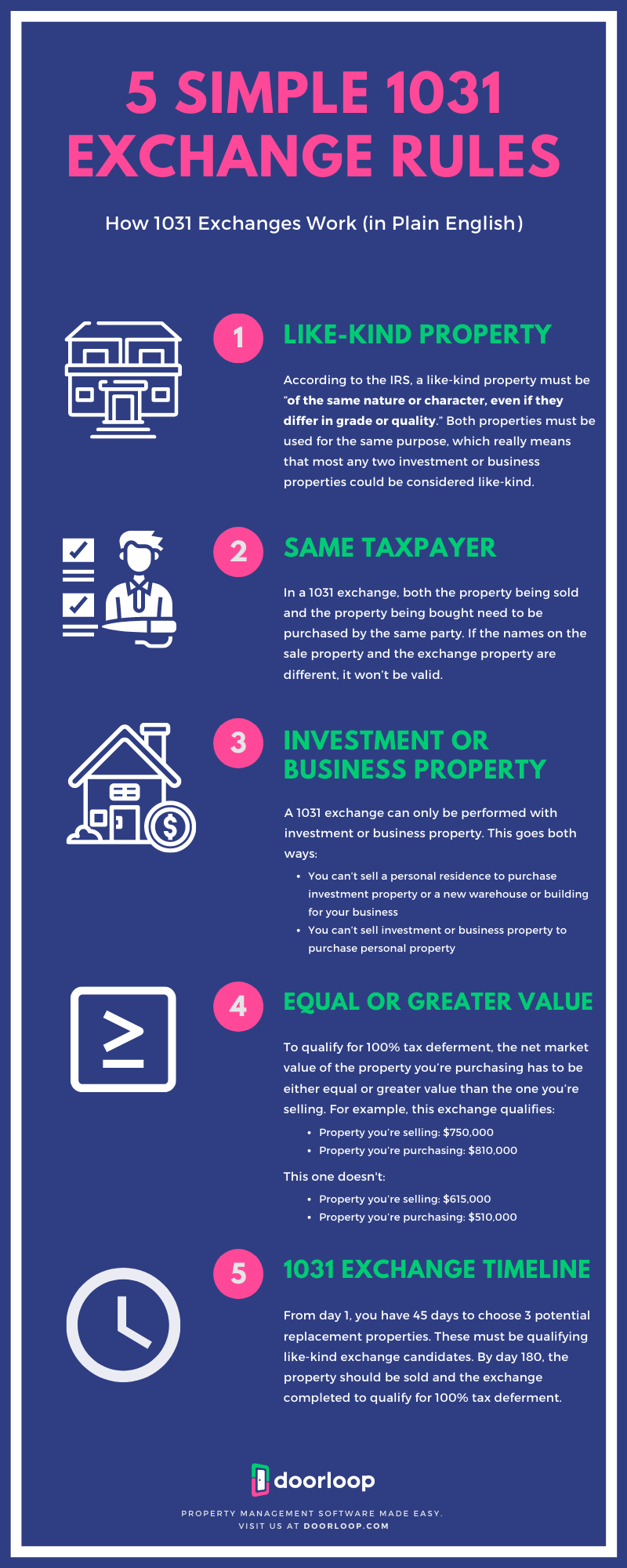

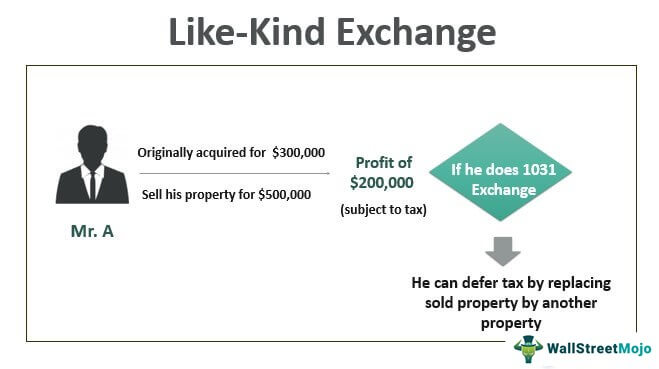

. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement property. However by using the process of a 1031 Tax Deferred Exchange a property seller can.

EXCHANGE ACCOMODATION FEE When an escrow transaction involves a 1031 Tax Deferred Exchangeor a simultaneous exchange of. The gain may be taxable in the current year. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

Although the numbers and the properties differ this is the type of question. A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000 apply it to the rental house purchase and delay the payment of the capital gains tax until you sell the new property. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you.

Cornerstone Combines The Power Of 1031 Securitized Real Estate. Legal Definition of tax-deferred. If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today.

Those taxes could run as high as 15 to 30 when state and federal taxes are combined. You can count on David and the entire team at Equity Advantage to steer you the right way. Although it turns out that a Starker Exchange is just a delayed 1031 exchange by any other name it helps to have an expert like David Moore to set you straight.

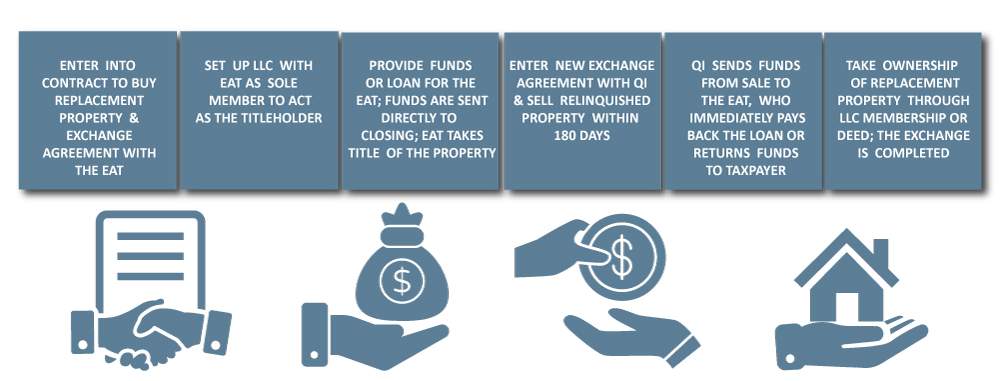

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. What is a tax deferred exchange. The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind.

1031 Tax Deferred Exchange Explained. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain. State federal and depreciation recapture taxes are deferred and the tax savings are invested in the new property.

By Randy Kaston on March 29 2022. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon the sale. The Complete Real Estate Encyclopedia by Denise L.

This property exchange takes its name from Section 1031 of the Internal Revenue Code. We want to help your 1031 exchange transaction go as smoothly as possible. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property.

This post was co-authored with John Starling Senior Vice President Northern 1031 Exchange LLC. Want to thank TFD for its existence. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

The correct name for a real estate transaction which is often erroneously called a tax-free exchangeSee 1031 exchange. Evans JD O. When selling real estate sellers can face significant tax obligations from the profit of the property sold.

Not taxable until a future date or event as withdrawal or retirement. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. A 1031 Exchange is the swap of qualified like-kind real estate for other qualified like-kind real estate structured pursuant to 1031 of the Internal Revenue Code.

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. Examples of Tax Deferred Exchangein a sentence.

What Is A 1031 Exchange Asset Preservation Inc

What Is A 1031 Exchange Properties Paradise Blog

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Asset Preservation Inc

1031 Exchange When Selling A Business

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

What Is A 1031 Exchange Mark D Mchale Associates

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

1031 Tax Deferred Exchange Explained Ligris

Like Kind Exchange Meaning Rules How Does 1031 Works

Are You Eligible For A 1031 Exchange